|

||||||||

|

||||||||

|

||||||||

|

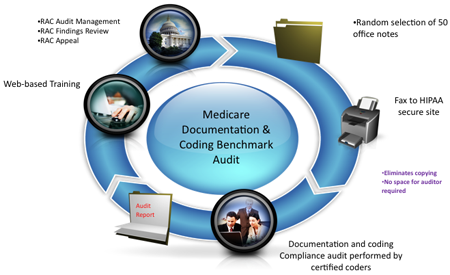

Prepare your practice for the impending CMS RAC (Recovery Audit Contract). Our team will provide a base-line audit on your documentation and billing practices. Our report will allow you time to make any changes in your current practices. RAC Base Line Audit What is RAC? The RAC(s)-Recovery Audit Contract will pursue the identification of Medicare claims which contain non-MSP improper payments for which payment was made or should have been made under part A or B of title XVIII of the Social Security Act. In 2006, Section 302 of the Tax Relief and Health Care Act made the Recovery Audit Contractor (RAC) program permanent. It is to be in place in all 50 state and Puerto Rico no later than 2010. The stated goal of the recovery audit program is to identify improper payments made on claims of health care providers provided to Medicare beneficiaries. These may be either overpayments or underpayments. A demonstration program in California, Florida, and New York was deemed successful and as a result Congress made permanent the RAC program. The demonstration in those 6 states resulted in the return of over $900 million in overpayments to the Medicare Trust Fund between 2005 and 2008 while nearly $38 million in underpayments was returned to health care providers. What does this mean to me? Prepare your practice for the impending CMS RAC (Recovery Audit Contract). Anyone who files claims with Medicare will be audited, to start no later than January of 2010. This includes physicians, hospitals, home health agencies, and Durable Medical Equipment providers. Waiting for Medicare to audit you can prove costly if you do not know where you may be improper in your billing or coding. The RACs are compensated on a contingency basis, so you can be sure they will be aggressive in their audits. Any overpayments found by the RACs will need to be reimbursed to Medicare, which can collect their reimbursement from any future claims checks owed to you. So why should I use your service for a baseline audit prior to being audited by the RAC? By using a third-party audit in advance, your practice can identify improper billing and coding and take necessary corrective actions prior to the RAC audit. This can help you save both time and money. In addition, you may find areas in which you are being under reimbursed as well. The audit works both ways. If you have been underpaid due to incorrect coding, etc. then you may collect that amount. Our process is easy and turnaround time is quick. We will provide you with a base line audit of your practices billing and coding. Our audits are performed by certified coders who have extensive experience doing government audits. After receiving the information we need from you, a report will be delivered approximately one week later. We will go over that report and help identify and make suggestions as to areas for improvement. Prepare your practice for the impending CMS RAC (Recovery Audit Contract). Our team will provide a base-line audit on your documentation and billing practices. Our report will allow you time to make any changes in your current practices. Preparing for the Medicare RAC Audit

More Information

Contact a representative today to speak with a representative regarding this amazing service! |

||||||||

|